The coronavirus pandemic has exposed “cracks” in the global financial system and “will likely” see banks suffer both credit losses and market losses that will test their reserves, the International Monetary Fund (IMF).

The spread of the coronavirus has so far claimed more than 145,000 lives and infected more than 2 million people. Death rate by the coronavirus have exceeded those from the SARS outbreak in 2002-03. SARS killed 774 people and infected almost 8,100 people in 26 countries over eight months, according to the World Health Organization.

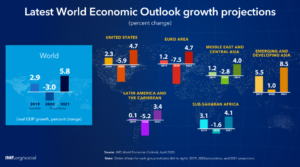

Deutsche Bank remains careful on Chinese equities as it wait for more information on the economy and the coronavirus outbreak, according to the global chief investment officer of Deutsche Bank’s wealth management business. The bank has adopted a “wait-and-see approach” for now, but reduce in the rate of infection could be a benchmark for investors to look at the market again. Deutsche Bank expects the slowdown in China to cut off 0.2 to 0.3 per cent of the global economic growth this year. The investor estimates global GDP to expand slightly above 3 per cent in 2020, in line with the estimates of the IMF.

Bank of America is warning that global economic growth in 2020 will likely be the worst the U.S. has seen in years, at least since 2009, in part because of the coronavirus outbreak. Bank of America Global Research foresees the growth of gross domestic product (GDP) globally could fall to 2.8 percent for 2020, which would be the first sub-3 percent reading since the conclusion of the financial crisis in the second quarter of 2009, according to a CNBC report.

The research recommends the recent outbreak of the coronavirus plays a important factor in global economic activity, as more industries are affected by delays as the virus spreads. Economists from the Bank of America research group also point to the U.S.-China trade war and political vagueness as slowing growth. Bank of America’s studies showed that interruptions in global supply chains halting from the coronavirus outbreak could lower GDP growth, as well as a decline tourist flow to and from Asian countries.

When The Economy will Recover?

A lot depends on the epidemiology of the virus, the effectiveness of containment measures, and the development of therapeutics and vaccines, all of which are hard to predict. In addition, many countries now face multiple crises—a health crisis, a financial crisis, and a collapse in commodity prices, which interact in complex ways. Policymakers are providing unprecedented support to households, firms, and financial markets, and, while this is crucial for a strong recovery, there is considerable uncertainty about what the economic landscape will look like when we emerge from this lockdown.

Though the scale of today’s crisis may be larger and the contours certainly different than that of 2008 notably, we are facing a supply shock as leaders are rightly enacting measures to physically prevent industries from operating the fact is that in its interconnections, today’s economy is structurally similar to the one that was in place a little over a decade ago.

Promoting the recovery will have its own challenges, including higher levels of public debt and possibly new swaths of the economy under government control. But relative success in Phase 1 will ensure that economic policy can go back to its normal operation. Fiscal measures to boost demand will become increasingly effective as more people are allowed to leave their homes and go back to work.

Interest rates and inflation were projected to be low-for-long prior to the pandemic in most advanced economies. Preventing major disruptions in supply chains should avoid inflation during the emergency and recovery phases. If the measures to contain the spread of the virus are successful, the necessary increase in the public debt ratio will have been sizable, but interest rates and aggregate demand are likely to remain low in the recovery phase. Under those circumstances, fiscal stimulus will be appropriate and highly effective in most advanced economies. And this will facilitate exit from the exceptional measures introduced during the crisis.