COVID-19 related economic disturbance is potentially more severe than those we have witnessed during the global financial crisis of 2008

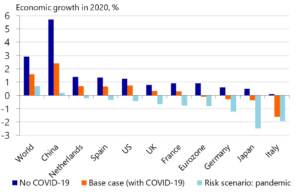

The global spread of the coronavirus COVID-19 is a human tragedy that has disrupted many industries and sectors across the world. Such an abrupt rise in unpredictability can put both economic growth and financial stability at risk. In addition to targeted economic policies and fiscal measures, the right monetary and financial stability policies will be vital to help the global economy. Monetary and fiscal policy have been doing their part. In fact, monetary relieve added approximately 0.5 percentage points to global growth last year. Forty-nine central banks cut rates 71 times as part of the most corresponding monetary action since the global financial crisis.

Financial year have tightened significantly in recent weeks which means that companies are facing increase of funding cost which affect the market place. Such a sudden, sharp tightening in financial condition badly effect on the economy.

Monetary policy Response During COVID-19

COVID-19 related economic disturbance is potentially more severe than those we have witnessed during the global financial crisis of 2008. The coronavirus pandemic is a different kind of shock. Never before have modern economies shut down straight away. From one week to the next, many workers lost their jobs and paychecks. Restaurants, hotels, and airplanes all emptied. And consumers and businesses now face steep losses in income and potentially widespread bankruptcies.

The sharp tightening in financial condition along with expectation of low inflation means that monetary policy play a significant role at the current juncture. Central banks can act quickly to help ease the tightening of financial conditions by combination of debt and cutting interest rates, thus preventing a possible credit crunch. Synchronized actions across countries increase the power of monetary policy. Therefore, global cooperation to synchronize monetary policy must be high on the plan. Ample liquidity within countries, and across borders, is the prerequisite to the successful reversal of the rapid tightening in financial conditions. In these unusual circumstances, if liquidity pressures threaten market functioning, central banks may need to step in and provide emergency liquidity.

If economic and financial conditions were to deteriorate further, policymakers could return to the broader collection that was developed during the financial crisis. For example, the Federal Reserve launched the Term Asset-Backed Securities Loan Facility in 2009, which provided targeted funding. The Bank of England and U.K. Treasury introduced the Funding for Lending Scheme, where a funding aid was provided to motivate the expansion of lending to households, small and mid-sized enterprises and non-financial corporates.

Financial stability policies

The sharp decline in interest rates, combined with growing anxiety about the economic outlook, have also raised investor concerns about the health of banks. Banks’ share prices have fallen sharply, and bond prices of banks have also come under some pressure likely reflecting fear of potential losses. Supervisory authorities should, however, monitor developments at banks very closely. Given the temporary nature of the virus outbreak, banks could consider a temporary restructuring of loan terms for the most-affected borrowers. Supervisors should work closely with banks to ensure that such actions are both transparent and temporary. The goal must be to preserve banks’ financial strength and overall transparency across the financial sector.

Authorities should also be aware to possible financial stability threats from outside the banking system. This requires an increased focus on asset managers and exchange-traded funds, where investors might reimburse risky investments suddenly. Overall, policymakers must act decisively and cooperate at the global level to protect monetary and financial stability during this time of extraordinary challenges. The IMF will act as needed to help its members face this extraordinary, but hopefully temporary, crisis.